|

| Vein Gold in Core |

For companies exploring in Canada summer is usually, but not always, peak drilling season. The fact is that a company can drill in winter as well and in some areas, especially swamps and lakes, winter drilling is really the only alternative.

With most of the drilling occurring between late April and early November, drill core begins to come into the labs in early summer and continues to be assayed right through the fall. Which means that there is usually a flow of press releases beginning in September and going right through until the Christmas doldrums.

Market reaction to drill results can be counter-intuitive. A set of solid results may be taken as a sell signal in some market conditions. In fact, the tone and tenor of the market, as much as grams per ton of gold tends to determine any particular results' reception.

Gold $3000 | Silver $60 is about how to make significant money in a precious metals rally. In such a rally, particularly in the later stages of the rally, decent drill results can trigger huge rises in share price. Not because they are, in themselves, brilliant. Rather, because they draw the attention of an already excited market to a particular stock.

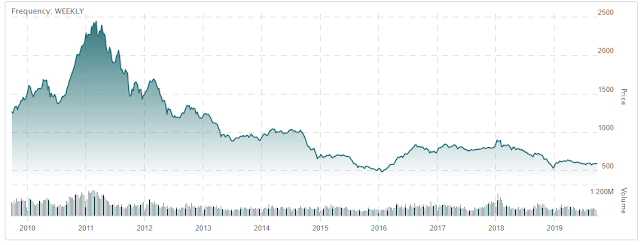

In my view, we are just entering the first leg of a multi-year precious metals rally similar to the 2008/2011 rally. There are going to be ups and downs while gold works its way back to its 2011 peak of $1889, fully $350 over its current price. As that first leg is built, companies will be releasing this years drilling results into a firming but not yet exuberant market. Good results will move stock but not by nearly as much as they will move them next year when the precious metals rally is in full spate.

Watching the results come out in the next few weeks will give early investors a good look at which Canadian juniors are proving to have prospective ground. Looking at White Gold's (V.WGO) anticipated series of results from its huge Yukon holding and keeping an eye on Aben (V.ABN) Resources Golden Triangle results from northern British Columbia will position an early investor to be ready when solid, hard, news comes.

Canadian results are robustly seasonal, but there are also Canadian listed companies which are drilling in less climatically challenging environments and which can produce drill results year-round. Goldplay Exploration (V.GPLY) has established a 43-101 compliant silver resource on its Mexican property. But it is also finding a good deal of gold and releasing news very regularly. Right now Goldplay is under the radar but it is exactly the sort of story which could explode in a major metals rally.

Each of these companies is trading well below its 2019 high. The fact that we are in the early stages of a precious metals rally actually gives investors a bit of time to accumulate positions at relatively low prices. Once the rally takes root shares in junior explorers will begin to attract speculative investment from people who don't want to miss out. At that point, a single good drill hole can double or triple a stocks' value literally overnight.