In retrospect, a major Precious Metals rally is easy to spot.

Gold ran to an all time high from 2005 to 2011. However, there was a drop on the way up for the financial crisis of 2008.

If we zoom out a little we see that in the 2011 rally, gold actually traded higher than it previous peak price in early 2008 before falling off.

My own view is that we'll know we are in a major precious metals rally when gold tops its previous high of $1889/oz. My book is called Gold $3000 | Silver $60 because I suspect those will be close to the peak prices achieved in the next rally. Essentially, I expect gold to come close to doubling its 2011 high over the next couple of years. Yes, it could go higher, much higher, but that would be event driven and none of the events that could drive gold to $5000 or $10,000 are very probable.

What is probable are ordinary course price pressures. The advent of negative and near negative interest rates, deficit spending without end, the gradual decline of the UD dollar as a "safe haven" are all going to contribute.

The appetite of central banks for gold has been increasing with Poland, China and Russia leading the charge. There has also been a rise in demand for gold backed ETFs which, in turn, means more gold is being purchased,

The gold producers are producing more gold than ever but the rate of growth in that production has been slowing.

We are certainly not going to have a gold "shortage" to drive up the price; but there is every chance that the majors will find themselves bumping into physical and financial limits to gold production. Where the gold price was fairly stable from 2012 forward, multiple factors seem to be pushing it higher.

The early stages of a gold and silver rally are apparent to people inside the business but opaque to the general investing public. It is not until gold, in particular, reaches a fairly arbitrary number, in this case I suspect its 2011 high of $1889, that the media and a wider audience begins to pay attention. At that point, the precious metals rally will be between a third and half over.

In Gold $3000 | Silver $60 I make the argument that in a major rally the truely significant profits will not be made in the metals themselves or the major producers or even mid-tier and small producers - although they will all do well - rather it will be the junior explorers and developers which will see their share prices go parabolic.

However, right now, the junior market with a very few exceptions is just limping along. Good results are still being treated as liquidity events. This parallels the junior experience in the 2008/2011 rally. In the earlier rally it was not until the last third of the rally that the junior market really took off.

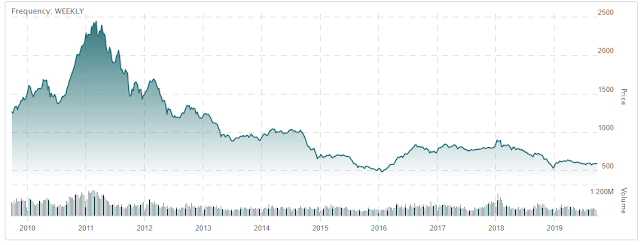

For the moment the signs suggest we are at the beginning of a rally. In particular, we have seen the senior producers as represented by the GDX move up towards 2016 highs. (But still well off 2011 prices.)

The more junior GDXJ is well below its 2016 highs and massively below 2011.

The TSX-V (which includes beaten up oil and gas, pot and crypto companies) remains flat on the floor.

If we are at the beginning of a significant rally no one has gotten around to telling the stock market yet. Which is typical of the beginning of precious metals rallies.

So has the precious metals rally started and will it be similar to 2011? Or will it be a false start rally like 2016?

Either way, the junior market is poised to take off. The only question is when?

No comments:

Post a Comment